Staking is Similar to a Deposit. You give your coins to someone, and they pay you regular interest on your deposit.

It’s important to know that, like deposits, staking can be flexible, allowing you to withdraw your rewards and deposit at any time, or fixed, where you lock your funds for a specific period (10 days, a month, 6 months, a year, etc.) and either can’t withdraw early or can, but lose all accrued rewards.

Staking on an Exchange

The safest staking is on an exchange. For example, on Binance, you can stake 500 USDT at 15%, and anything above 500 USDT at 5% per annum. The exchange pays the interest and also acts as a security guarantor for the funds. However, keep in mind that the exchange can refuse service to citizens for political reasons or block accounts for suspicious activity. Generally, an honest person shouldn’t be afraid to store some funds on an exchange, but relying entirely on it is not advisable.

Staking on a Decentralized Exchange

In addition to centralized exchanges like Binance, there are decentralized ones like PancakeSwap. I will discuss the features of decentralized exchanges separately. For now, you should know that such exchanges don’t require registration; your account is your non-custodial crypto wallet, which you need to connect to the exchange. The exchange will see all assets in the wallet and allow you to trade or invest them in staking programs. This might sound more complex and confusing, which it is, and also riskier, but such exchanges often offer higher interest rates.

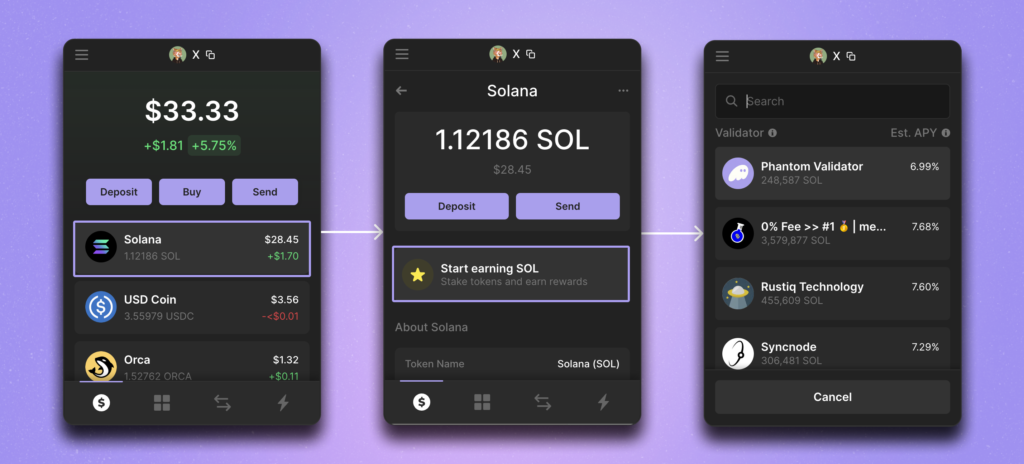

Staking in a Wallet

Often, the non-custodial wallet you use will offer its native staking with rewards. If the wallet is trustworthy, you can use it. For example, in Telegram, you can stake their native TON at 3.28% per annum. Not very appetizing, but you can withdraw your coins at any time. Always remember, if staking promises a high percentage, there are risks involved.

Staking in a Protocol

Typically, such staking is done via a smart contract. The protocol can accept certain assets, which will be locked in the smart contract for a specific period or until certain conditions are met. While centralized exchanges are rarely hacked, decentralized ones are even rarer, but smart contracts and protocols are frequently targeted. Considering such deposits as long-term investments is very risky, but in the short term, if you are confident in the technology and the team behind it, you can earn super profits for taking such risks.

How Do They Make Money from You?

This is where it gets interesting. You need to understand that no one just gives away money for free. When we deposit money in a bank, and it promises 15% per annum, it means the bank can efficiently use our money, earning, for example, 30% per annum by lending our money to others. To understand the reasonableness of the interest offered and assess the risks, you need to understand how they earn from your money, at least basically.

- Centralized Exchange. It’s simple here; the exchange is like a bank. At a minimum, it also issues crypto loans, and at a maximum, it invests users’ money in risky instruments, which we will consider later. However, it may have insider information and can influence the market if the exchange becomes large enough. For example, it can “shave shorts and longs,” but that’s more complex, and I’ll discuss it much later.

- Decentralized Exchange. Such an exchange cannot manage users’ funds like a bank or centralized exchange. Usually, its staking programs are always fixed, and the coins are locked in smart contracts. So how does it earn rewards for us?

- For example, each project that wants to start trading on this exchange (get listed on the exchange) can offer a certain amount of tokens for its staking programs. Thus, the exchange receives free tokens and distributes them in its staking protocols.

- The exchange may have its token. On BakerySwap, it’s BAKE; on PancakeSwap, it’s CAKE, etc. The primary holder of the emission (issuance) of this token will be the exchange and its investors. The exchange and investors are interested in seeing this token increase in value. For the token to grow, people must want to buy it and not sell it, meaning demand exceeds supply. Therefore, the exchange benefits from allowing people to stake its native tokens for rewards. The ideal scenario for the exchange is: I am the exchange, I have 1 billion DEX tokens worth $3 each. I allocate $100 million so that everyone who stakes DEX tokens for 3 months receives 150% annual rewards. This unprecedented action makes people rush to buy and stake (thus locking for 3 months) these tokens on the exchange. I gradually sell these tokens to them at $3, then at $4, $5, etc. Ultimately, as an exchange, I earn $200 million from selling my tokens. Then 3 months pass, the payout program ends, people rush to sell their locked tokens, and they plummet in price. Since there’s no demand, they drop below the former $3, possibly to $2. And who buys them? Right, the exchange itself. The exchange spends $50 million out of the $200 million earned to buy back the tokens. This means there’s money to launch an even more generous staking program, drive the token price even higher, and earn even more. As users, we must remember that when you stake an asset (if it’s not a stablecoin), it might not yield a profit that covers the devaluation at the moment of unlocking and withdrawing the token from staking.

- Staking in a Wallet and Protocol. These usually work similarly to a decentralized exchange. Generally, the protocol has its token, and the wallet does too. Everyone wants to earn.

But not everything revolves directly around money. Sometimes a project needs to make a loud statement, attract an audience, get into the media, show investors that the number of users is growing, collect large statistical data, conduct stress testing, and so on. Projects allocate budgets for such campaigns. For example, Telegram recently launched an integrated crypto wallet in its messenger on its TON blockchain. In this wallet, you could stake up to 3,000 USDT for 4 weeks, with the first 2 weeks earning 50% annual TON coins based on the coin’s rate at the time of accrual, and the next 2 weeks earning the same TON at 25% annual. Such an action is purely marketing. Telegram wants to introduce its users to crypto and attract crypto enthusiasts. It will earn from them later. The platform’s authority is impressive. Even if the protocol is hacked, Durov will likely value his reputation and cover the theft from his funds. Ultimately, users in such staking risk only that the awarded TON will depreciate, and staking rewards will be less than expected. Under-earning is not scary; losing the initial capital is.

So, is it profitable to stake or not?

Ultimately, you should always stick to your strategy. If you buy a coin with a plan to hold it long and confidently (a year, two, three), you should stake it even for a small percentage. Any risky staking with a high percentage is better done only with stable coins in constant demand, like Ethereum or stablecoins.

What is considered a low percentage or a high percentage?

I would say anything above 20% is a high percentage. Anything below 5% is not worth attention. Even if staking seems risk-free, like staking ETH on an exchange at 1.28%, there are risks. The exchange can be hacked, and your account on the exchange can be hacked. The exchange can be sued, and you can too. There are many risks, and taking them for a few percentage points is not worth it.

If I find a site where I can stake coins at 1,000%, is that great?

This is a complex question. Firstly, do you trust this site/exchange/protocol enough to entrust your money to it? If yes, keep in mind that if the site is reliable, it will run an advertising campaign and tell everyone and everywhere about such a generous offer. In that case, the more people stake their assets, the faster the deposit percentage will drop.

I staked my coins at 777% a week ago, and today I see that the conditions have changed, and the coins now yield only 30% per annum. Why?

This is a direct consequence of the previous question. Usually, a specific volume of rewards is allocated for staking in the protocol. The more people (or rather, coins in quantitative terms) participate in the staking program, the fewer rewards from the total pool participants receive for staked coins.

If I follow staking programs and stake coins only at 100%, and when the rate drops, withdraw and switch to more profitable coins that can be staked at over 100% per annum?

Firstly, this approach requires a lot of time and energy to monitor and manage assets. Secondly, remember that all transactions in blockchains cost money. Withdrawing money from one platform to another and exchanging one coin for another can cost more in fees than the “super-profitable” staking will bring in 5 days of high interest. So, switching assets and choosing staking programs must be approached very carefully.