The first thing to know is that anyone can create a coin on a popular blockchain and set any price for it. Therefore, the price of a coin, even if it is higher than Bitcoin, is irrelevant. What matters is whether you can sell the coin at that price.

Now, let’s dive deeper. We already know that coins “live” in blockchains, and some coins are used across multiple blockchains and can move from one to another via bridges.

For example, Sol is the coin of the Solana blockchain, AVAX is Avalanche, BTC is Bitcoin, ETH is Ethereum, ATOM is the Cosmos blockchain, and so on.

USDT is available in more than ten blockchains, while ETH is available in other blockchains as a wrapped asset.

What’s important to understand here is that if people use a blockchain, they pay transaction fees in that blockchain’s native coin. This means there will always be demand for such a coin. USDT and other stablecoins are also necessary for conveniently converting money and transferring it from one blockchain to another. And stablecoins more or less have real backing.

So why are there tens and hundreds of thousands of other cryptocurrencies? Here, we need to look at each specific coin individually. Let’s analyze the current top by market capitalization:

- BTC: Everyone knows this is the most well-known asset in the world. Besides being used for transaction fees in the Bitcoin network, it is also traded on exchanges as an ETF.

- ETH: Similar to Bitcoin, ETFs are coming soon. It should be added that Ethereum, as a blockchain, is technically more convenient than Bitcoin. It has lower fees and supports smart contracts. In general, it’s a dream blockchain.

- USDT: The world’s main stablecoin, which says it all.

- BNB: The coin of the world’s largest exchange, Binance. The blockchain has cheap transactions, making it attractive for launching projects. The exchange often gives free tokens to BNB holders, making it a desirable investment.

- Sol: Probably the most hyped blockchain. Its transaction fees in SOL are very low, making it easy to launch gaming projects, NFTs, and meme coins. If there’s hype in the industry, Solana will definitely support it.

- USDC: The second-largest stablecoin in the world, which also makes sense. At the very least, you can diversify your holdings between USDT and USDC.

- XRP: Another popular blockchain coin with cheap and fast transactions. Unlike Bitcoin, Ethereum, and Solana, the Ripple blockchain is semi-closed, and only approved teams can develop projects on it.

- TON: The coin of the blockchain from the Telegram team, currently hyped and actively developing.

- Doge: Something unusual for our list. Initially a meme coin created as a joke, it became so popular that it developed further. Now it exists in many networks and has become a popular means of payment. Hence, it’s no surprise it’s in the top 10 cryptocurrencies. Plus, Elon Musk keeps pumping it.

- ADA, AVAX, TRX: I grouped these three together as they are coins of different blockchains. ADA has been promising to become the best blockchain in the world for many years but hasn’t succeeded yet. TRX and the Tron blockchain are very fast and cheap ways to transfer stablecoins. Typically, Tron is used for transfers when buying or selling cryptocurrencies through physical exchanges. I’m not even sure what to say about AVAX and Avalanche; it’s a blockchain that seems to be alive.

So, the top 10 has no random coins, not even momentarily hyped ones. Generally, the only newcomer here is TON; the rest have been in the top for years.

This leads to the question: if a coin is not a means of payment for fees, a convenient means of payment, or a stablecoin, what is it needed for at all?

Short answer: It’s almost not needed for anything.

Long answer: Let’s analyze it in detail.

Why are small coins needed?

You came to read about crypto. When did you first learn about it and when did you remember it? It’s obvious that it often happens when a coin suddenly bursts into the media hype. For example, Trump’s token skyrocketed 100 times after debates, or #GME, #KITTY, #ROAR skyrocketed due to tweets from Roaring Kitty when he played with GameStop stocks again. Seeing such growth, many try to jump on the rocket, buy these coins, and get rich. Spoiler: it’s usually too late.

But what can we conclude? Coins are needed for someone to make money on them. All the infrastructure around the coin is needed to create value in people’s eyes, sell coins, buy them back at a significant drop, create new newsworthy events to boost interest and sell them at the peak, then buy them back during dips, and so on in a loop.

Sounds sad, right? But major price movements are driven by selfish manipulations. This is emphasized by market trends. When Bitcoin drops by 10%, all useless (and that’s 99.9% of coins) coins drop by 40%. Bitcoin drops another 20%, and altcoins (as all alternative coins are called) drop another 90%. Only rare, genuinely needed coins can resist. Usually, these are coins of growing and genuinely used blockchains, like ETH or TON.

Metrics for each coin

But there must be some way to evaluate a coin, right? Absolutely. We must always remember that behind all coins, there could be some behind-the-scenes games, as in the stock market, but there are things we can still find out. Let’s look at the metrics of a coin using MANTA (Manta Network) as an example.

Basic knowledge

First, look at what the project is about. Manta is a project that lives in two blockchains: Polkadot and Ethereum. In Ethereum, Manta has its own subnet, a so-called layer 2 solution. This means that from the main Ethereum network, coins can be transferred via a bridge to Manta’s subnet and used there. In this layer 2 network, transaction fees are paid not in ETH but in Manta, which is good and cheap. In the Polkadot blockchain, Manta also has its own network with its fees.

Okay, we figured out the blockchains. Why is this project needed? There is a concept called ZK – zero knowledge. I’ll explain its essence in a separate post. But the idea is that Manta has developed a technology allowing developers to easily and quickly deploy zk-applications in their network. Their network is less loaded than the main Ethereum network, fees are lower, transactions are faster, but the connection to the main network remains. Hence the benefit of using this subnet.

Complicated, but we figured it out. It turns out the project sounds useful, serious, and complex. Let’s analyze further.

Basic metrics

Now go to Coingecko, Coinmarketcap or DropsTab. The simplest information is the coin price. As I wrote earlier, it doesn’t tell us anything. Even the price change chart doesn’t tell us much. Let me explain why.

Market Cap

Each coin has its current total value. For example, at the time of writing, Manta’s market cap was almost $300 million. This is the total price of all issued coins at the current price. Importantly, if all issued coins were to flood the market, it would be impossible to sell them for $300 million because the price would drop due to excess supply. But it’s an abstraction important to us, like a company’s market capitalization on the stock market.

Circulating Supply

Here we have two numbers. First, how many coins are currently issued on the market. It’s important to understand that some coins have a limited supply, like Bitcoin. Yes, it can be mined, but only 21 million coins can ever exist. The last Bitcoin is expected to be mined around 2140. Some coins are inflationary, for example, printed by 10% annually. Everyone has heard about inflation, right? The dollar, euro, and ruble are all inflationary and constantly being printed. And there are deflationary coins that burn more coins than they generate new ones. Moreover, a coin can change its status. For example, ETH was always inflationary, then switched to a deflationary model, and now it’s inflationary again.

So, Manta currently has almost 340 million coins in circulation, which is nearly 34% of the total supply.

Unlocks

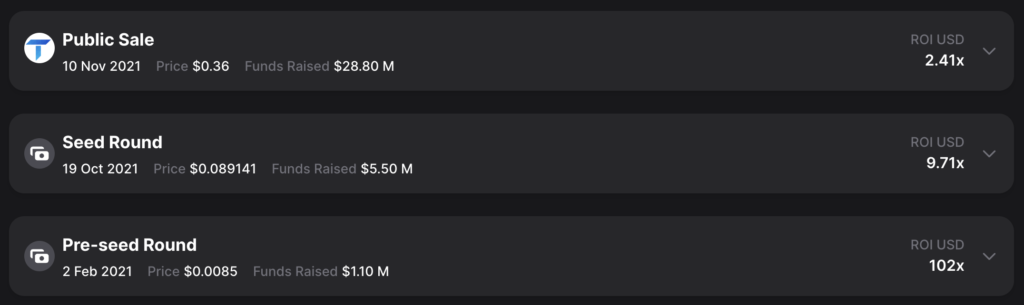

Does this mean new coins only appear through mining? Of course not. Usually, a project has investors who provided money at the start. They are entitled to a certain number of coins. An ICO (public pre-sale) may be conducted, where coins are sold to everyone willing to buy them at a fixed or dynamic price before listing on an exchange. There are also coins allocated to the project team, a fund for external developers and marketing (treasury), and so on. It’s important to note that such coins are usually not issued to everyone at once, as this would crash the price. Such coins have a cliff – the date when coin issuance starts, and vesting – the schedule for coin issuance. For example, I participated in an ICO and bought Manta coins at $0.36 for $2,500. On the listing day, 50% of the coins are unlocked for such investors. Then, over 6 months, the remaining purchased tokens are unlocked in equal portions each month. So, it turns out someone managed to buy these tokens very profitably 3 years ago. And someone like strategic investors even earlier and more profitably. They periodically have new coin volumes unlocked, which they will sell at a good price to lock in profit. All this can be viewed in the Vesting tab, but not all investment rounds will have the exact price listed, as some rounds were closed.

So, with 340 million coins issued and a coin price of $0.86, the total market capitalization is $300 million. If a year from now there are twice as many coins and the price is still $0.86, it means the project’s market cap has doubled! Although it seems to us externally that the project is not growing and the price is stable. This is a very important factor indicating that not all coins increase in price, and not all coins are worth holding in the hope of growth. Their market cap can grow, the funds and project owners will successfully sell unlocked coins, and we will watch the unchanged price for years. And in the worst case, with an increasing number of coins in circulation, their price will drop with each unlock.

Volume 24h

Another important parameter for each coin is the trading volume over 24 hours. This figure shows the total trading volume – the sum of how much was bought and sold. For example, for Manta, this volume is almost $19 million. If the volume is less than a million, it means the coin is basically not needed by anyone, and no one is buying or selling it. This is a red flag.