This is one of my favorite topics. It seems simple with stablecoins. The largest ones now are USDT and USDC. The first is a crypto dollar from the company Tether, hence USDT, and the second is from the company Circle. In theory, both companies claim that each issued stablecoin is backed by a real dollar, which is either physically stored in a bank account or invested in risk-free assets such as U.S. Treasury bonds. Both companies regularly undergo private audits and claim that their funds are fully backed. Moreover, they regularly boast about their high revenues.

How are stablecoins issued?

Suppose I am a large centralized exchange. I need to maintain the ability to exchange all popular cryptocurrencies for USDT because it is much more convenient for people to buy coins through the dollar and use dollar prices rather than buying ETH for BTC or SOL for DOGE. As an exchange, I go to Tether, transfer 1 billion dollars to them, and receive 1 billion USDT in return. That is, the circulating volume of stablecoins should be less than or equal to the amount of funds that were physically transferred to them. The company guarantees that at any time I can transfer the stablecoins back to them, and they will give me my real money one-to-one, and the stablecoins will be burned (irreversibly sent to a null wallet that no one has access to) since these stables will no longer have real financial backing.

But demand is a dynamic thing. There are many “free” stablecoins on the market that can be bought by exchanging any of your coins (Ether, Bitcoin, etc.) for them. That is, an ordinary person does not need to contact Tether to buy 1,000 USDT. This is convenient. But it turns out that stablecoin is also a market asset, meaning that demand for it can increase and decrease. And not always for 1 USDT will you get 1 dollar. But usually, the rate fluctuates within tenths or hundredths of a percent, which is hardly noticeable on small amounts and not critical on large ones. But even in stablecoins, there can be force majeure situations. There was a short time when 1 USDC fell to 0.88 USD. There was also the well-known complete collapse of UST, when the stablecoin practically went to zero within a few days, and everyone who held their funds in it lost up to 90% of their assets.

Are there different stablecoins in each blockchain?

Yes and no. For example, USDT is now available in 14 blockchains, and USDC in 15. But if 112.3 billion USDT were issued, this does not mean that there are that many in each blockchain. On the contrary, this figure is the sum of all stablecoins across all blockchains. And if I have USDT in Ethereum, when I transfer them to the Solana network, they will disappear from Ethereum and appear in the Solana network. On the one hand, this can be done through a bridge. Or you can deposit them on an exchange in the Ethereum network (to the USDT ETH address in your exchange account) and withdraw them to the Solana network to your non-custodial wallet. Sometimes this is easier and cheaper than using a bridge.

So how do companies make money on stablecoins?

It is clear that all companies issuing stablecoins (Tether, Circle, and others) can invest the funds given to them as collateral for issuing stablecoins. For example, Tether reports that its reserves consist of various assets, including cash, short-term deposits, as well as commercial paper, corporate bonds, secured loans, and U.S. Treasury bonds. That is, roughly speaking, they make at least 5% per year. But they also have unique sources of income.

For example, at the request of authorities (usually U.S. authorities), Tether happily blocks the accounts of terrorists, fraudsters, and sanctioned individuals. Moreover, it blocks the stablecoins on accounts and wallets but does not block the backing assets. So the accounts are blocked, but Tether continues to earn on them.

Another way to make money is to buy coins when the rate deviates downwards. Imagine you issue USDT, and you know that all your USDT is backed in U.S. or Chinese banks. But suddenly, there is a media rumor that you failed an audit, your investments were unsuccessful, and there is actually no money on the accounts to back the entire circulating volume of USDT. People rush to sell USDT, exchanging them for USDC or even withdrawing them into real assets, asking you for their return. You calmly buy your dollars for 0.9 and up to 0.99. Then you publish a detailed financial report confirming that the market panic was premature and continue to sell your crypto-dollars one-to-one with real dollars. And what if you secretly bought a network of anonymous Telegram channels and can launch such news yourself? Gold mine!

And the last way. When a new promising blockchain is launched, it needs to attract money. Stablecoin is the most convenient way to inject money into a blockchain, but only if these stablecoins work in the new blockchain. Below in the screenshot, I will show how far USDT is ahead of all others in terms of the volume of issued coins, so to attract users to your blockchain, it makes sense to pay the USDT team to mint their coins in your network and manage them. How much this might cost is hard for me to say, but an extra million dollars is never unnecessary, and what if this new blockchain also takes off, like TON? Do you think it’s a coincidence that Pavel Durov gave his first interview in a long time on April 16, and on April 18, TON network added USDT support?

FAQ

If I see a stablecoin dropping in price, can I profit from it?

It is important to understand that when a stablecoin drops momentarily, as in the example above by 5-10-15%, it can quickly return to its “pegged” dollar value. But the risk of buying a falling stablecoin outweighs the potential profit. For example, when Bitcoin drops by 10%, it can grow by 30% in a month or continue to fall. But a stablecoin will either continue to fall or return to its value of 1 dollar; it is unlikely to grow more than a dollar.

With a depeg, everyone rushes to sell stablecoins, and their rate can fall momentarily; can there be growth above 1 dollar?

It happens. For example, a new stablecoin appears with very favorable staking programs at the moment (I will talk about them in one of the following articles). The issuing company does not have time to issue coins to meet demand, and demand exceeds supply. But usually, this all evens out in a few hours. However, where demand can be consistently high is in crypto exchanges. For example, in Argentina, due to a difficult economic situation, 1 USDT can fetch more Argentine pesos than 1 paper dollar. It happens that crypto exchanges also run out of USDT, and they start selling them not for 1 dollar but for 1.1 and even higher. But seriously profiting from this is only possible with very large volumes.

Why are all popular stablecoins pegged to the dollar?

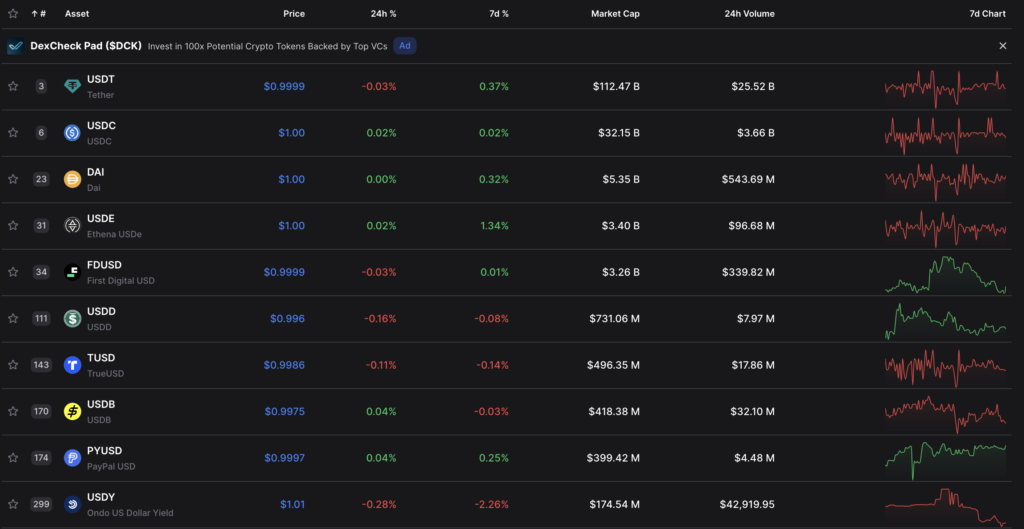

This is an excellent observation. Just as the dollar still rules the classic financial world, the crypto world revolves around the dollar. Stablecoins are pegged to the dollar, and the reserve assets for stablecoins are usually also based on the U.S. economy. This is a significant risk. If the dollar starts to have problems, so will crypto. Of course, stablecoin-issuing companies will try to diversify their collateral portfolios at the first sign of danger; some may already be doing so. But the threat exists. Here are the top 10 stablecoins, and they are all dollar-pegged. The nearest in euros ranks 12th and has a capitalization of only 120M compared to the billion-dollar capitalizations of top crypto dollars. So when diversifying your assets, remember that sometimes Bitcoin can be more reliable than stablecoins. However, if the U.S. economy experiences problems, Bitcoin won’t be unaffected either.

USDT leads with a capitalization of 112.47 billion. And if USDC is almost four times smaller, the rest are tens and hundreds of times smaller.